Beijing, May 9 (Reporter Zhang Ni) Recently, the nine-valent cervical cancer vaccine (HPV vaccine) was approved for listing in China, bringing good news to many women. HPV vaccine is the first vaccine in the world to include cancer as an indication. However, for many domestic people, this vaccine is still new, and the popularity of related knowledge is still limited.

How to vaccinate? How to choose the vaccine type that suits you? What preparations need to be made before vaccination? A few days ago, the reporter from Zhongxin. com interviewed Zhao Yun, deputy chief physician of gynecology department of Peking University People’s Hospital, on a series of issues of public concern.

— — What is the relationship between HPV virus and cervical cancer?

HPV is the abbreviation of the English name of "human papillomavirus". There are many members in the HPV family, and a few of them are closely related to malignant tumors, so they are called high-risk HPV. From the statistics of large population samples, 99% of cervical cancer is caused by infection with this kind of virus.

The main route of transmission of HPV virus is through sexual contact, and mucosal contact can also be transmitted.

When there is no sexual exposure, the probability of this virus infection is almost zero, but the probability of HPV infection in women who have sex is very high. About 70% to 80% of women may have been infected with this virus, especially when they are sexually active (usually before the age of 30), which is the peak of infection.

However, many infections are transient infections. With the increase of age, these viruses will be cleared away, and only a small number (10-15%) are in a state of persistent infection, which is the high-risk group of cervical precancerous lesions and cervical cancer.

— — What is the difference between bivalent, tetravalent and nonavalent vaccines?

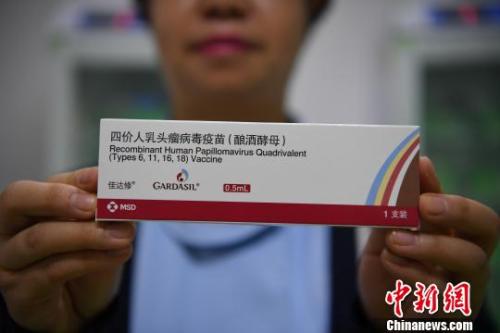

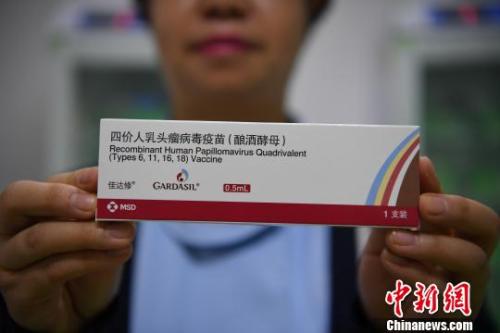

At present, there are three kinds of HPV vaccines listed in the world: bivalent, tetravalent and nonavalent.

A bivalent vaccine can prevent infections caused by HPV16 and HPV18 viruses. International research data show that more than 70% of cervical cancer is caused by these two viruses.

The tetravalent vaccine can prevent the infection of HPV6, 11, 16 and 18 viruses. Although HPV6 and HPV11 are not high-risk HPV viruses of cervical cancer, they can cause condyloma of lower genital tract.

Nine-valent vaccine is aimed at nine subtypes of HPV6, 11, 16, 18, 31, 33, 45, 52 and 58. Studies show that nine-valent vaccine can prevent 90% of cervical cancer.

It should be pointed out that HPV vaccine can not prevent cervical cancer 100%, even after vaccination, cervical cancer screening should be carried out regularly.

— — What is the difference between the three vaccination ages?

In terms of vaccination age, the approved vaccination age in China is: bivalent vaccine is suitable for women aged 9-25, tetravalent vaccine is suitable for women aged 20-45, and ninevalent vaccine is suitable for women aged 16-26.

The division of age groups is determined based on the results of clinical experiments of different age groups in China. HPV vaccine is a preventive vaccine. At present, no results show that it has the effect of preventing diseases for people who have been infected with HPV virus contained in the vaccine. Therefore, population vaccination before sexual exposure has the best health economic effect.

In the position paper updated by WHO in May 2017, it is suggested that women aged 9-14 who have not had sex should be the main target population, and women over the age of 15 should be the secondary target population.

— — Is the applicable age of nine-valent vaccine in Hong Kong 9-45 years old?

The instructions for the nine-valent vaccine in Hong Kong are applicable to 9-45 years old. However, there is no clinical data on the effectiveness of using HPV nine-valent vaccine in people over 26 years old.

Hong Kong’s approval of the application for the elderly is mainly based on the effectiveness of the tetravalent vaccine for the elderly population. The nine-valent vaccine and the tetravalent vaccine are immune-bridged, so the application range is 9-45 years old.

— — Is it still useful to vaccinate married and fertile women?

Some married and fertile women have not been infected by the virus, or have not been infected by the HPV subtype contained in the vaccine. At this time, vaccination is also effective.

— — How many times does the vaccine need to be vaccinated?

The bivalent, tetravalent and nonavalent vaccines all need to be injected in three times and completed within six months.

Among them, bivalent vaccine is recommended to be inoculated in October, January and June, with a total of 3 doses. The second dose can be inoculated 1-2.5 months after the first dose, and the third dose can be completed 5-12 months after the first dose.

Four-valent and nine-valent vaccines are recommended to be vaccinated in October, February and June, with a total of three doses. The interval between the first dose and the second dose should be at least one month, and the interval between the second dose and the third dose should be at least three months. All three doses should be completed within one year.

— — Is it still necessary to vaccinate with nine valence after vaccination with four valence?

At present, there is not enough evidence to prove that it will be more beneficial to vaccinate another series after completing one series of vaccines.

From the clinician’s point of view, women who have been vaccinated with one of bivalent, tetravalent and nonavalent vaccines and completed all injections can prevent more than 70% of cervical cancer. Another HPV vaccine injection is not recommended.

The instructions for the nine-valent vaccine mentioned that after the third dose of tetravalent HPV vaccine was inoculated, the nine-valent vaccine was injected at least 12 months apart.

— — How long is the vaccine valid?

Bivalent and tetravalent vaccines have been on the market for more than ten years. At present, the research data show that the antibody level of the vaccinated population is still at a high level, and there is no evidence that it is necessary to strengthen vaccination.

The nine-valent vaccine was launched in 2014. Studies on people aged 9-15 and 16-26 showed that serum antibodies remained positive in the fifth year after vaccination. At present, there is no evidence of the need for intensive vaccination.

— — What tests should I do before vaccination?

No special examination is needed before vaccination. However, in my personal opinion, people who have been sexually exposed and have never been screened for cervical cancer before should be screened. The purpose of screening is to know whether they have cervical lesions.

— — Which groups are not suitable for vaccination?

People who are allergic to the active ingredients used in the vaccine or any dressing adjuvant should be prohibited from using it. People who have had hypersensitivity after injecting HPV vaccine should not be vaccinated again.

In addition, women who are pregnant and pregnant are not recommended to be vaccinated now. Although a large number of practices that have been put on the market have proved that there is no data showing that the vaccine will affect the growth and development of embryos, pregnancy preparation and pregnancy are special periods, so it is not recommended for such people to be vaccinated immediately.

— — What are the side effects of the vaccine?

At present, the safety of the vaccine is still very good. Vaccination of this kind of vaccine is the same as other vaccines. The common systemic adverse reactions are mainly headache, fever, nausea and dizziness, and the local adverse reactions are mainly pain, swelling, erythema and itching.

— — Can men be vaccinated?

At present, all vaccines approved in China are used by women to prevent cervical cancer.

In foreign countries, tetravalent vaccines approved by some countries can be used for male vaccination. Male vaccination can also prevent precancerous lesions of some reproductive organs, condyloma and so on.

In addition, male vaccination is beneficial to the emergence of group immune effect, which reduces the overall infection rate of HPV virus in the population.

— — What are the precautions for preventing cervical cancer?

To prevent cervical cancer, in addition to vaccination, regular screening should be conducted, especially for women who have had sexual exposure.

For healthy people under the age of 30, it is suggested that only cell screening should be carried out. If the screening result is negative, it can be checked again after 3 years. For healthy people over 30 years old, it is recommended to carry out cell screening and HPV virus examination. If the results are double negative, they can be examined again after 5 years.

Early sexual exposure, many sexual partners, active sexual behavior and unclean sexual behavior are all high risk factors for cervical cancer, so condoms are recommended for safe sex. In addition, developing a healthy lifestyle is also beneficial to the prevention of diseases.